TPD Lawyer Brisbane, QLD No Win, No Fee TPD Claims

Are you in Brisbane and unable to work because of an injury or illness? A TPD lawyer focuses on Total and Permanent Disability (TPD) claims, working tirelessly to secure the financial compensation you deserve through your superannuation or insurance policy. We’ll help you get through this challenging time while you focus on your recovery.

TPD claims are made to access your TPD insurance, which is often included as extra insurance provided by your superannuation fund. TPD insurance is paid out as a lump sum and can help when you and your loved ones need it most. It’s worth noting that your injury does not need to be related to work to qualify for TPD compensation. However, your superannuation claim may also include income protection.

If you’re considering making a TPD claim, it is important to talk to one of our lawyers so WT Compensation Lawyers can be there for you every step of the way. We can give you legal advice and guidance throughout the claims process.

Should I Get a Lawyer for a TPD claim?

Yes, as TPD claims can be quite complicated. Our team has experience dealing with TPD claims, and we know the ins and outs of the law. Moreover, we understand the claims process, so you won’t have to worry about it. We’ll help you avoid stress and mistakes, fill out the correct paperwork, and make sure your claim is properly submitted so that you have the best chance of success. Likewise, we’ll handle all the communication with your superannuation fund or insurer for you.

Do you need a TPD lawyer in Brisbane? Contact us today to begin your journey towards fair compensation for your TPD claim. We are No Win, No Fee TPD lawyers in Brisbane, and we offer free initial consultations for all new clients.

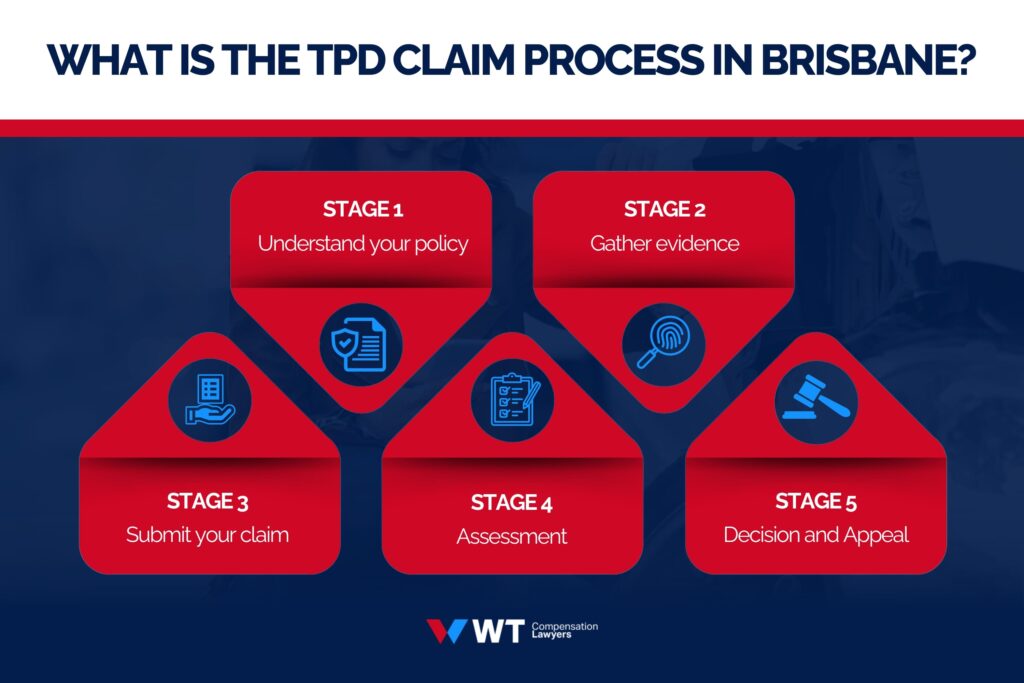

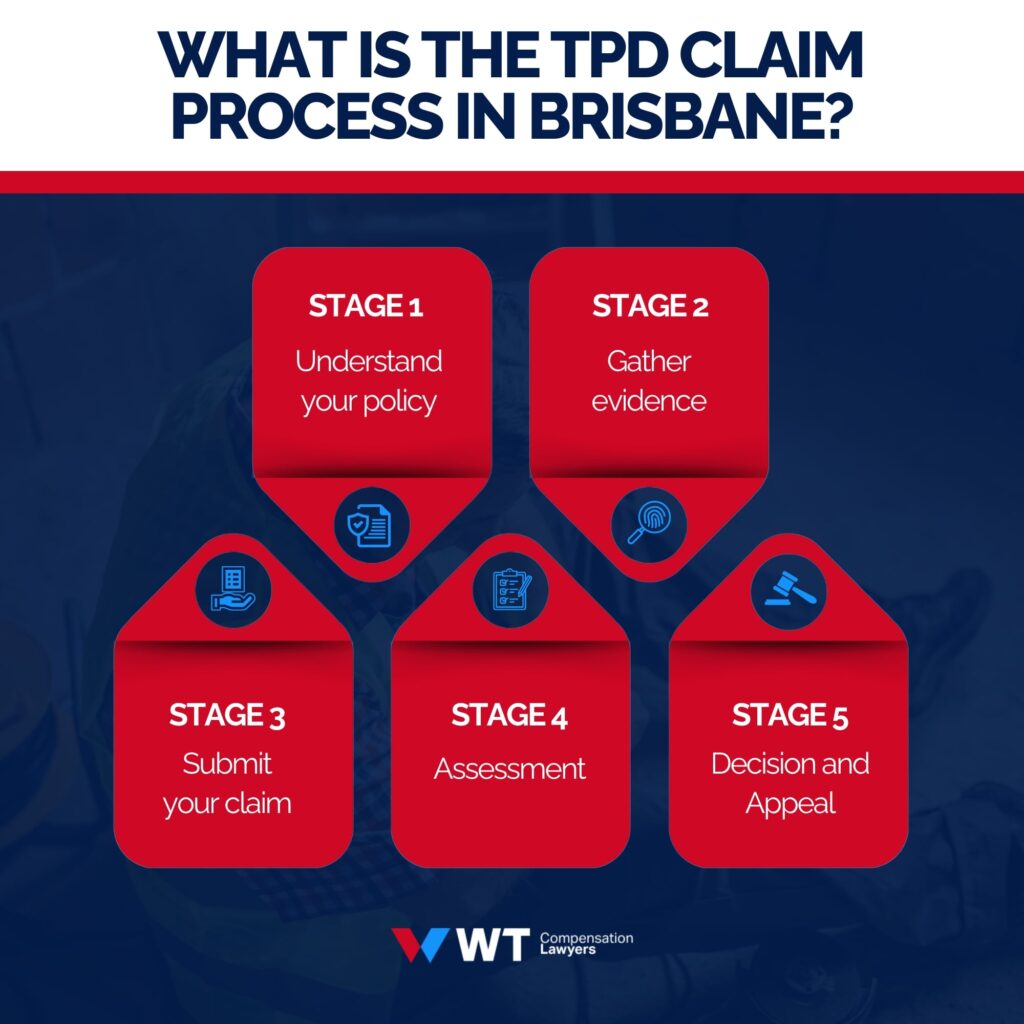

What Is the TPD Claim Process in Brisbane?

Facing disability can be overwhelming, but know that you’re not alone. The TPD claim process offers financial support during this difficult time.

Stage 1: Understand your policy

We start by reviewing your superannuation and/or insurance policies to understand their TPD definitions and eligibility criteria. Many people don’t know that you can make a TPD claim against all of your super funds if you have more than one. This is why it’s important to have a lawyer look into your benefits and policy details.

Stage 2: Gather evidence

We’ll compile your medical records, specialist reports, and income statements to demonstrate your disability and its impact on your ability to work.

Stage 3: Submit your claim

We’ll contact your super fund or insurance provider to initiate the claim process. They’ll provide claim forms, and we’ll ask about any specific requirements. Once completed, we’ll submit your claim forms on your behalf.

Stage 4: Assessment

The insurer will assess your claim based on your policy terms and the evidence you’ve submitted. The insurer may request additional information or medical assessments.

Stage 5: Decision and Appeal

The insurer will communicate their decision – approval or denial. If denied, you have the right to appeal with supporting evidence or legal assistance. Appeals can be complicated and there are strict time limits, but WT Compensation Lawyers will help you through this process if your claim is rejected.

Even if at fault, you may have a right to compensation. Start your claims check:

🔒 FREE CLAIMS CHECK TAKES 2 MINUTES

Who Can Make a TPD Claim?

You can make a TPD claim if you have a total and permanent disability, meaning:

- You’re unable to work: You can’t earn income in your usual job or any occupation because of your illness or injury.

- Your disability is permanent: Your disability is expected to last for the rest of your life.

Eligibility

Eligibility for a TPD claim also depends on the following:

| Factor | Description |

| Policy coverage | TPD insurance is included in your superannuation or a separate insurance policy. |

| Policy definitions | Each policy defines “total” and “permanent” differently, so carefully review yours. |

| Evidence | Strong medical records and proof of your disability’s impact on your ability to work. |

What Is My TPD Payout Worth?

Many TPD payouts range from $20,000 to $200,000, but some TPD payments can be much higher than that, sometimes going up to and over $1 million. However, this may not be the case for you and your claim. Like people, each case is unique. Moreover, as you may have more than one active super, your final payout amount would be quite different from someone with only one active super and different insurance benefits. If you have a TPD claim in Brisbane, it’s best to consult with a legal professional to understand your individual rights and potential compensation.

Contact Our TPD Lawyers About Your TPD Claims

We understand that life can present unexpected challenges, and when faced with a TPD, understanding the legal landscape can be daunting.

Our dedicated team of TPD lawyers is here to offer compassionate support and guide you through the legal complexities with empathy and care. At WT Compensation Lawyers, we believe in more than just legal expertise – we believe in understanding the human side of your challenges.

We’ll stand by your side throughout the process and fight for the support and compensation you deserve. In Brisbane, trust WT Compensation Lawyers to handle your TPD case with sensitivity and professionalism.

TPD Claims FAQs

You have 28 days to request an internal review by your super fund or insurer. You can submit additional evidence supporting your claim during this time. If you’re with QSuper or the Australian Retirement Trust, you can expect a response in 30 to 90 days, depending on the type of claim and complaint.

If you disagree with the review outcome, you can initiate an external review through the Australian Financial Complaints Authority (AFCA) within 12 months of the initial decision. They will independently assess your case. As a final step, you can appeal the AFCA’s decision with the Administrative Appeals Tribunal (AAT) within 28 days.

According to Insurance Watch, TPD claims took an average of 7.5 months to be accepted in 2022. In our experience, it often takes 12 to 14 months for a TPD claim to be concluded. Notably, the time frame varies depending on how complex your case is as well as the chosen resolution path. Internal reviews are usually resolved within 45 days. AFCA reviews may take 3 to 6 months on average. With AAT hearings, the wait time can range from several months to over a year.

In 2022, the acceptance rate for TPD insurance claims across the industry averaged 86.8%. Resolution Life/AMP boasted the highest claim acceptance at 93.6%, while AIA fell behind at 77.8%.

The tax on your TPD payout depends on the type of payment and your individual tax circumstances. Lump sum payments are usually taxed as income at your marginal tax rate, with exemptions or concessions available in certain cases. Like superannuation pension payments, income stream payments are taxed at different rates based on your age and the type of pension you receive.

Contact Us

When it’s time to talk, we’re not just lawyers – we’re compassionate listeners. Join us for your free consultation, and let’s take the first step together towards securing the compensation you rightfully deserve.

What our clients say

Even if at fault, you may have a right to compensation. Start your claims check:

🔒 FREE CLAIMS CHECK TAKES 2 MINUTES

Back to Top: Injured at Work? What to Do After a Work Accident

Jono, Sinny and everyone at WT Compensation Lawyers are the best car accident lawyers in Brisbane I’ve come across. The genuine care, compassion and human kindness they show to their clients is clear from the very first moment you speak to them. I cannot recommend them enough to anyone in need of a personal injury lawyer and would not hesitate at all to refer any of my family or friends. Thank you guys always for all your great work.

I highly recommend Jono, Sinau and the entire team at WT as personal injury lawyers for anyone in Brisbane looking for the best representation. Jono is a step above other lawyers, both in knowing his craft but also in the way he treats his clients like one of his own family. From the very first moment I met him, he has treated me with respect, kindness and compassion and I am glad to say we have become good friends. WT are genuine and very good people who want nothing more than to do the best thing by their clients so THANK YOU for all that you do.

Life changing. Seriously. I would highly recommend Jono without any hesitation to anyone in Brisbane looking for the best car accident lawyer. The word grateful doesn’t even begin to express how I feel after having Jono look after me after my car accident claim. He has single handedly changed my life and has given me an opportunity to move on with a bright future after some of the toughest times after my accident. I previously used a big personal injury firm, one that has ads on tv and big marketing budgets for an old work accident and the experience isn’t comparable at all. Care, empathy, compassion, kindness and always had time for me, no matter what time of day/night or how silly my question was. Jono always made me feel like I was important and always kept me updated with everything that was going on. I only wish I had used WT for my old work accident. My result I got far exceeded my expectations and is only a testament to the great personal injury lawyer that Jono is. If you’re still looking for a car accident lawyer just seriously stop and give Jono a call. You will not regret it.

I can’t thank Jono enough for his outstanding work after my motorcycle accident. His dedication, expertise, and genuine care made all the difference in my case and surprisingly turned a horrific situation into a positive one for me. From day one, he took the time to understand my situation, became a very real pillar of support for me, and kept me informed every step of the way. Jono’s strategic approach and relentless advocacy got me a life changing outcome beyond my expectations. If you’re searching for the best personal injury lawyer in Brisbane who truly goes above and beyond, Jono is your go-to guy. He’s also a great bloke which I’m sure is clear to everyone who has the pleasure of crossing paths with him. I’m so grateful for his expertise, support and friendship and writing this review is just a very small way of me thanking him for changing my life.

Sinau and the team at WT Compensation Lawyers have been nothing short of amazing. From the beginning, they made me feel comfortable with the process and were so easy to contact. Sinau was very professional and always calling me to keep me updated with my claim. He would always go out of his way to make sure my family and I were okay which I am really grateful for. His kind words and professional advice during a dark time in my life was the glimmer of hope that I needed to keep going. I will always be recommending Sinau and the team at WT to my friends and family, as I truly believe they are the best WorkCover lawyers in Brisbane. From the bottom of my heart, thank you for looking out for your Pasifika people Sinau. It is rare that we see people like you who genuinely care for our community and for that I thank you.